Lesson 1: Understanding the Fundraising Landscape

Welcome to Your Fundraising Journey

Starting a fundraising journey is like preparing for a long trip. You need to know the possible routes, understand the terrain, and pack the right tools. In this lesson, we'll explore how money actually flows from investors to startups.

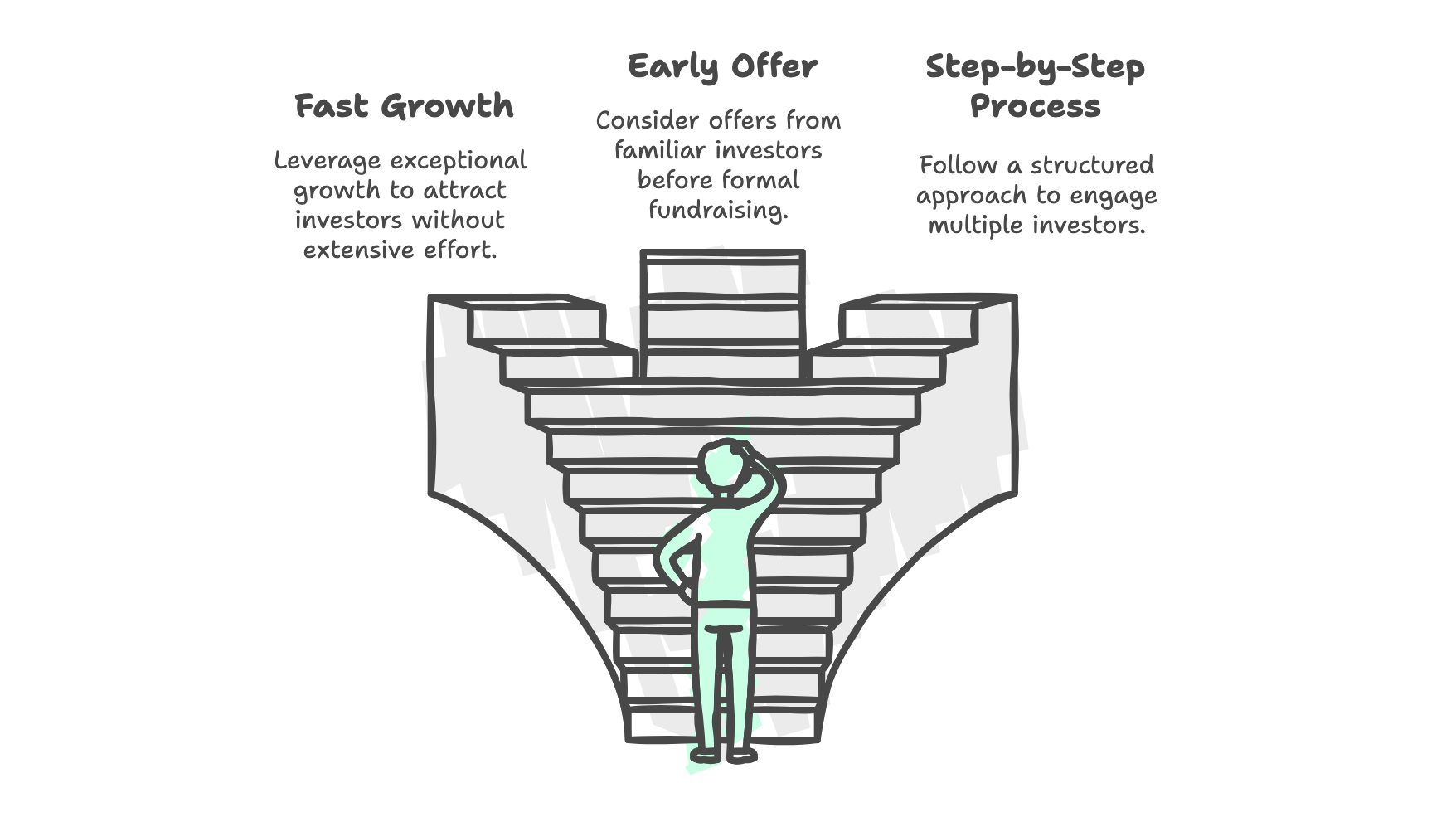

The Three Ways Companies Get Funded

1. The Growth Story

Picture a restaurant that becomes so popular, customers line up around the block. They don't need to advertise - their success brings people to them. Some companies grow so quickly that investors come to them the same way.

What does this really look like?

- Your monthly growth numbers are exceptional (often 20% or more)

- You keep getting emails from investors asking to meet

- Other founders mention investors are asking about your company

- You don't have to work hard to get investor meetings

2. The Early Offer

Think about a friend who spots a classic car in your garage and offers to buy it before you've even thought about selling. Sometimes, investors who know you well make offers before you start officially raising money.

What does this look like?

- You've built a relationship with certain investors

- They've watched you achieve what you promised

- They understand your business well

- They offer to invest before you start fundraising

Important: This only happens about 12% of the time. While it's nice when it happens, you shouldn't count on it.

3. The Step-by-Step Process

This is how most companies raise money. It's similar to a job search - you prepare your materials, get introductions, and go through multiple interviews.

What does this look like?

- Creating clear materials about your company

- Getting introductions to investors

- Having many meetings over several weeks

- Following up and managing the process carefully

How to Handle Each Situation

When You're Growing Fast

Stay organized and control the story:

- Track every investor contact in a simple spreadsheet

- Share consistent information with everyone

- Be clear about your timeline

- Stay professional, even when investors get excited

When You Get an Early Offer

Take your time and think carefully:

- Thank them and ask for the offer in writing

- Take time to discuss with your team

- Check if the money and terms work for your needs

- Consider running a quick process with other investors

When Following the Normal Process

Be prepared and organized:

- Get your materials ready before starting

- Plan for 2-3 months of meetings

- Meet with 30-40 investors

- Keep good notes

- Follow up quickly

- Stay on top of who's most interested

Common Mistakes to Avoid

- Starting too late (when you have less than 6 months of money left)

- Sharing different information with different investors

- Taking too long between meetings

- Not keeping track of conversations and follow-ups

- Letting investors string you along without clear next steps

Your Action Items

Before moving to the next lesson:

- Write down your current growth numbers

- List any investors you already know

- Calculate how many months of money you have left

- Start a simple spreadsheet to track investor conversations

Questions to Think About

- Based on your current growth, which path seems most likely for you?

- How much time do you have before you need to raise money?

- Who are the investors you already know who might be interested?

Remember: Most successful fundraising happens through the step-by-step process. While fast growth and early offers are great, it's smart to prepare for the normal path.

Next lesson, we'll talk about exactly when to start raising money and how to prepare your story.