Lesson 2: Getting Your Timing Right - When to Start Looking for Money

Why Timing Matters So Much

Think of raising money like planting a garden. Plant too late, and your crops won't have time to grow. Plant too early, and they might not survive. The same goes for fundraising - timing can make or break your success.

Understanding Your Company's Seasons

The Good Times to Raise

The best time to look for money is when your company is showing clear progress. This might look like:

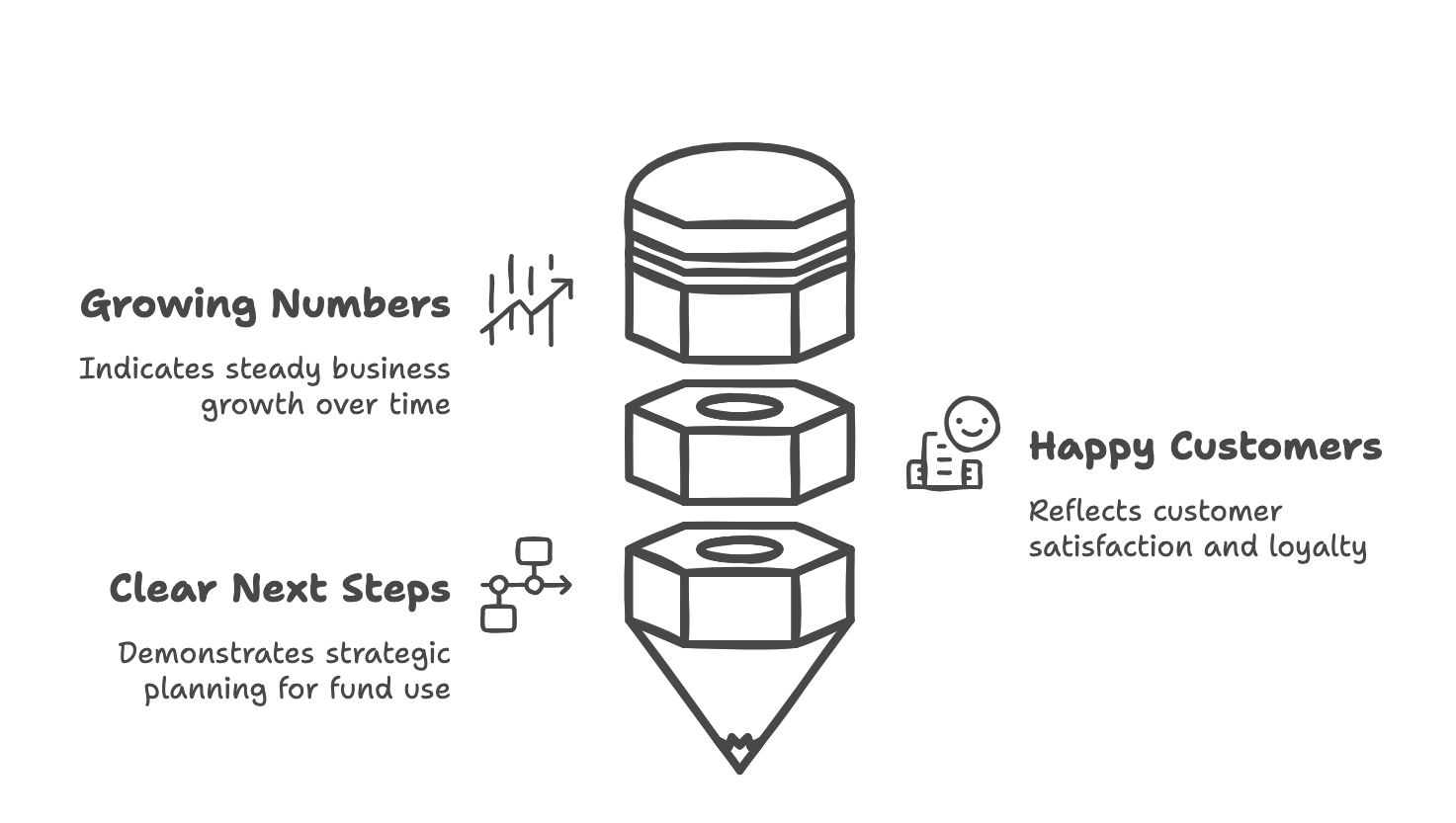

Growing Numbers:

Your business should show steady growth over several months. For example, if you're selling software, maybe you started with 10 customers, grew to 30, then 90, showing that more people want what you're building.

Happy Customers:

You have proof that people not only buy your product but love it. They're telling others about it, staying with you month after month, and maybe even buying more over time.

Clear Next Steps:

You know exactly what you'll do with the money. Perhaps you need to hire five key people, or you've found a marketing channel that works and want to spend more there.

Warning Signs That It's Too Early

If you see these signs, you might need more time before raising:

- Your product isn't fully working yet

- You only have a few customers using it

- Your growth is up and down each month with no clear pattern

- You're not sure how you'll use the money

The Perfect Window: Your Financial Clock

Think about your company's bank account like a clock counting down. Most successful companies start looking for money when they have about 12 months of spending money left. Here's why:

The Timeline Breakdown:

- Months 12-9: Prepare your materials and story

- Months 9-6: Meet with investors and negotiate

- Months 6-3: Close the deal and get the money

- Months 3-0: Emergency buffer (hope you don't need it!)

Real-World Example:

Let's say your company spends $50,000 each month. You have $600,000 in the bank. This means you have 12 months before running out of money. Perfect time to start preparing!

Reading the Market Weather

Just like checking the weather before a trip, you should understand what's happening in the investment world:

Good Weather Signs:

- Other companies in your field are raising money successfully

- Investors are actively looking for companies like yours

- Your industry is growing and in the news

- Similar companies are doing well

Storm Warnings:

- Many companies are having trouble raising money

- Investors are talking about "winter coming"

- Big companies in your field are struggling

- The news is full of economic worries

Making Your Decision: A Simple Test

Ask yourself these questions:

- "Can I clearly show 6 months of growth?"

- "Do I have enough money to last through a 6-month fundraising process?"

- "Can I explain exactly what I'll do with the new money?"

- "Do I have backup plans if raising takes longer than expected?"

If you answered "yes" to all four, you're probably ready to start preparing.

Your Homework: Getting Ready

1. Calculate Your Runway:

- Write down how much money you spend each month

- Count how much money you have in the bank

- Divide to find your months of runway

2. Track Your Growth:

- List your key numbers for the last 6 months

- Look for clear patterns of growth

- Note any big jumps or drops and why they happened

3. Make Your Money Map:

- Write down exactly what you'll do with the money

- Be specific about hiring plans

- Include marketing spending if relevant

- Add any other major expenses

Remember: The best time to look for money is when you still have plenty left. It gives you confidence in meetings and lets you take time to find the right partners.